Mobility Package

Easy compliance with EU mobility legislation.

Easy compliance with EU mobility legislation.

First step - First of all, you need to make your company account on postingdeclaration.eu

Second step - Upload your list of drivers

Third step - Create, edit and renew statements when necessary.

Documents required during the detachment:

Posting declaration

CMR, e-CMR

Tachograph files

In the case of an IMI portal check, the following documents must be submitted within eight weeks:

.DDD file

CMR or e-CMR

Remuneration calculation and proof of payment

Employment contract

Time sheets files

The laborious part cannot be outsourced, the provision of data is still up to you and your team.

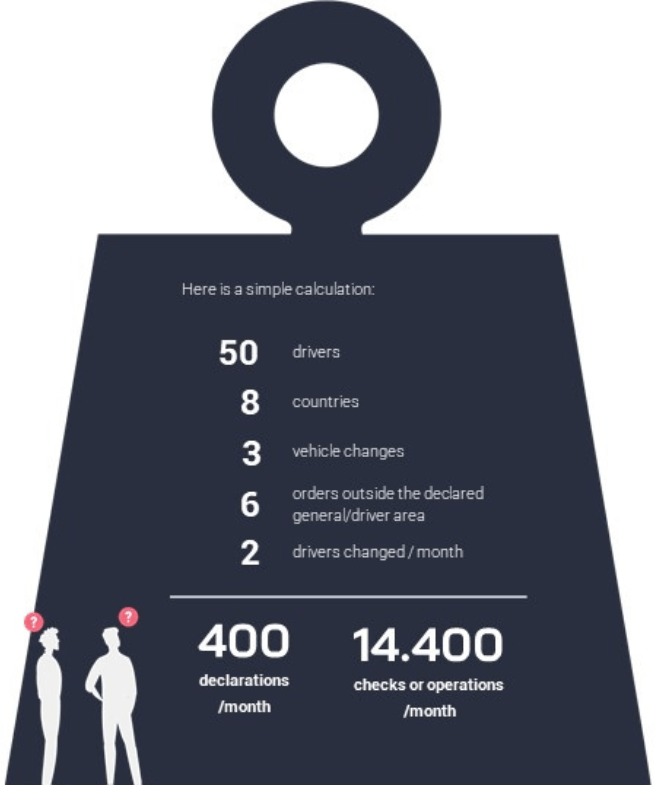

It’s easy to make a Posting Declaration, Right?

What about doing this for 17 different countries and 480 drivers each month?

And what about updating them with the right number plate as drivers switch trucks?

Who is monitoring if drivers are not entering countries without Submitted Posting declaration?

You need to have a team of robots to handle that!

Salary calculation according to Mobility Package can be tricky.

We created a ready-made automatically report that includes the right hourly-rate, the right number of hours for each driver and for each country, so you can relax and focus on business growth.

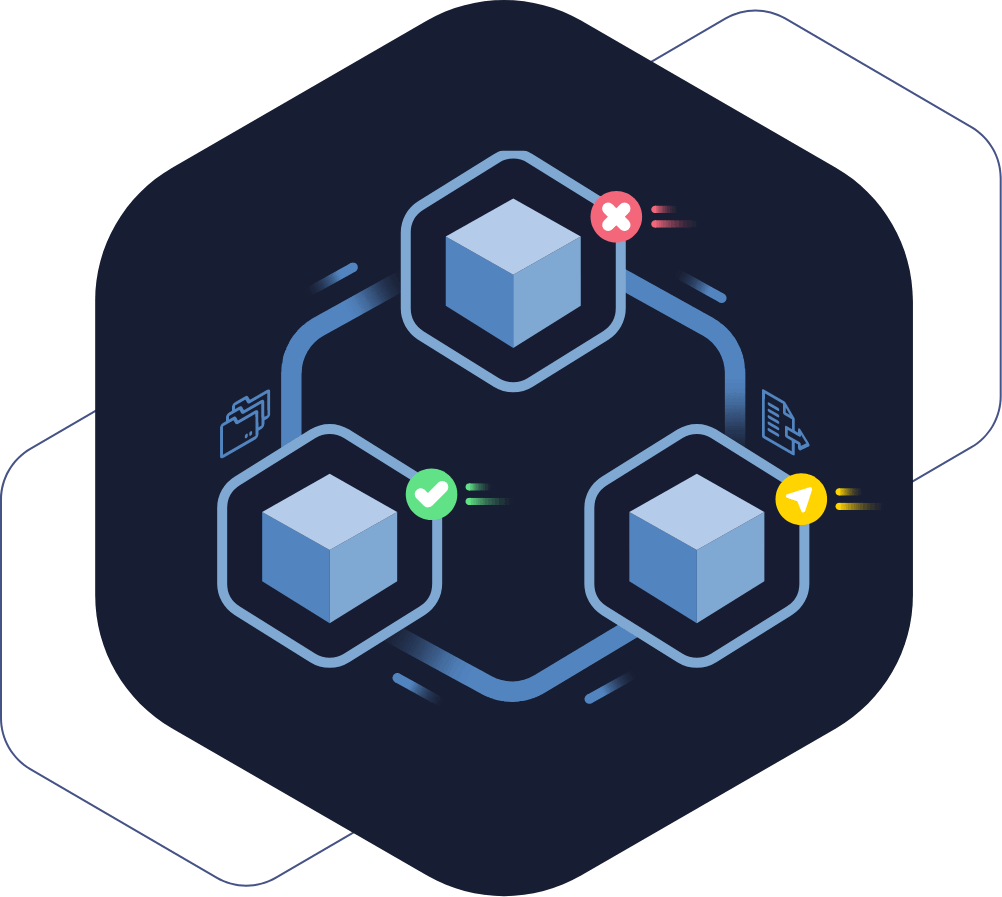

Posting Declarations

Software robot to create large volumes of posting declarations automatically.

Wage Calculation

Collect the right data to calculate driver's wage. Based on .DDD file downloaded daily.

Continuous Sync

Update and renew posting declarations based on Tachograph data.

Real-time Posting

Our Robot can create new posting declarations based on Telematics data.

Driver Mobile App

Posting declarations automatically synced to Driver App in real-time.

*FREE

5 euro

Per month